DeFi and CeFi crypto loans: Differences, risks, and benefits

DeFi and CeFi crypto loans are rapidly becoming a powerful alternative to traditional financing, offering fast, collateral-based access to liquidity without selling your crypto assets. Whether you’re a business holding Bitcoin or Ethereum or an individual exploring new ways to leverage your crypto, understanding the difference between these two models is key to making the right choice.

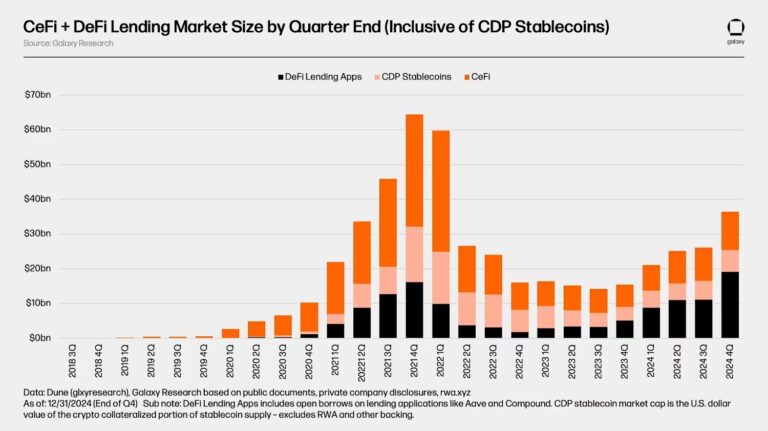

Both lending types have evolved significantly in recent years. According to “The State of Crypto Lending” Galaxy research, CeFi loan platforms reached a peak of $34.8 billion in outstanding loans before falling to $6.4 billion during the last bear market. But by the end of Q4 2024, the market had bounced back to $11.2 billion, showing a strong signal of renewed trust and usage.

And with MiCA regulation accelerating in Europe, the environment for crypto loans is becoming more transparent, safer, and more regulated. It’s an ideal time to explore how crypto loans could support your financial or business goals.

What are DeFi and CeFi crypto loans?

At the core, the distinction is simple:

- DeFi loans are decentralized; they run on blockchain protocols without intermediaries.

- CeFi loans are centralized; they are managed by a company or platform, much like a crypto-native bank.

Unlike traditional loans, which require bank approval, credit checks, and piles of paperwork, crypto loans are fast and collateral-based. You use your crypto, like Bitcoin or Ethereum, as collateral to borrow other assets, usually in stablecoins or even fiat. The result is a more efficient, often permissionless way to access liquidity.

DeFi crypto loans

DeFi loans are decentralized lending products built on blockchain protocols, using smart contracts instead of traditional intermediaries. Platforms like Aave exemplify how users can lend or borrow directly through transparent, automated systems. DeFi is ideal for users who value control, openness, and rapid access to liquidity.

Key benefits:

- Fully transparent: All activity is recorded on public ledgers, open for anyone to audit.

- No intermediaries: Smart contracts automate lending and borrowing; there is no need for bank approval.

- Global and permissionless: Available to anyone with a crypto wallet, with no identity verification required.

- Instant liquidity: Loans are executed automatically once collateral is locked.

- Flexible structure: No fixed loan terms; loans stay open as long as the collateral value remains sufficient.

- Programmable and composable: Integrates with other DeFi tools for advanced financial strategies.

- Market-driven rates: Interest is set dynamically based on supply and demand.

CeFi crypto loans

CeFi loans are centralized lending solutions managed by platforms that act as intermediaries between borrowers and lenders. Loans On Crypto is an example of such platforms, offering crypto-backed loans with more familiar UX and regulatory considerations.

Key benefits:

- User-friendly onboarding: Platforms provide intuitive interfaces, often with customer support.

- Crypto-to-fiat access: Easily convert borrowed funds into fiat currencies like EUR or USD for real-world use.

- Predictable terms: Fixed interest rates and repayment schedules offer more planning certainty.

- Regulatory compliance: Some CeFi providers operate under local financial regulations, offering clearer legal protections.

- Insurance and custodial safeguards: Certain platforms include coverage or safety nets for users’ funds.

- Familiar structure: CeFi models align more closely with traditional finance, making them accessible to non-crypto-native users.

Why request a crypto loan?

Whether you’re running a business or managing your personal finances, crypto loans can offer a smart, flexible way to access liquidity without selling your digital assets.

For businesses:

Crypto loans offer access to capital without the delays, paperwork, and restrictions of traditional banking.

- A real estate developer, for example, might use a crypto loan to fund the purchase of land or cover short-term construction costs without liquidating BTC holdings.

- Tech startups often turn to crypto loans to accelerate hiring, expand into new markets, or bridge financing rounds, especially if they’re already crypto-native.

By using crypto as collateral, companies can optimize capital allocation and maintain upside exposure to their digital assets.

For individuals:

Crypto loans provide a pathway to cash or stable assets without triggering a taxable event or giving up long-term investment positions.

- Need funds for a major purchase, travel, or emergency? You can borrow stablecoins or fiat while keeping your crypto portfolio intact.

- For crypto-savvy users, it’s also a way to leverage assets during bullish markets, borrowing against them to reinvest or diversify without selling.

In both cases, the flexibility, speed, and lack of bureaucratic friction make crypto loans an increasingly valuable financial tool, especially in a tightening credit environment.

Risks of crypto loans

While DeFi and CeFi crypto loans offer flexibility and access to capital, they also come with specific risks. Understanding these is essential before committing your assets.

DeFi risks

- Smart contract vulnerabilities: Bugs or exploits in the code can lead to unexpected losses or platform failure.

- Self-custody responsibility: You manage your own wallet and keys, so losing access means losing funds.

- Volatility and liquidation: Rapid drops in collateral value can trigger automatic liquidations.

- No customer support: Mistakes like sending funds to the wrong address are irreversible.

- Regulatory uncertainty: DeFi protocols may face future restrictions depending on local laws.

CeFi risks

- Custodial risk: Your crypto is held by the platform, so you don’t control your private keys.

- Platform solvency: If the provider mismanages funds or becomes insolvent, your assets may be at risk.

- Regulatory gaps: Not all CeFi platforms are fully regulated, and protections can vary by jurisdiction.

- Liquidity risk: Falling asset values may require additional collateral or force repayment.

- Indirect DeFi exposure: Some CeFi platforms reinvest user funds into DeFi protocols, inheriting those risks without full transparency.

Which one is better for you?

Choosing between DeFi or CeFi crypto loans depends on your goals, your risk tolerance, and how comfortable you are managing crypto assets.

For companies

The ability to unlock liquidity quickly, without selling core crypto holdings, can be a major financial advantage. Let’s look at a couple of examples:

- You’re a real estate development firm holding significant Bitcoin reserves. By using a CeFi loan, you can access EUR or USD to fund a project without going through bank approval processes or triggering a taxable event. CeFi platforms also often provide more predictable loan terms and compliance support, which is helpful for managing internal risk and reporting.

- You’re a tech startup that holds ETH in treasury and prefers the speed and programmability of DeFi loans. You can use those assets to borrow stablecoins instantly through a DeFi protocol, using that capital to scale faster, without negotiating with a lender.

For individuals

Your choice will depend on how involved you want to be in the process.

- As a crypto-savvy individual who’s comfortable managing wallets and smart contracts, you might prefer to use DeFi to borrow stablecoins against your ETH, reinvesting those funds or diversifying without selling.

- On the other hand, if you’re someone who prefers a simpler, supported experience and needs fiat access for travel, emergencies, or personal projects, you might opt for a CeFi loan, trading some control for ease of use, fiat integration, and potential customer support.

What you can do next

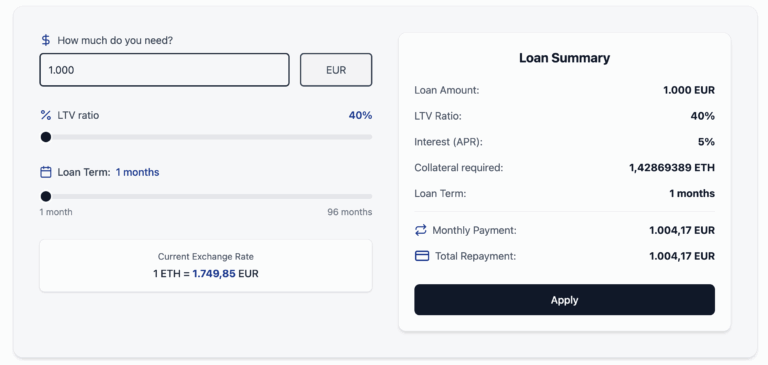

If you’re curious to see what kind of loan you could get using your crypto, Clovr Labs has developed a tool to help you calculate your potential loan. It is based on your crypto holdings, collateral type, and liquidity goals.

Whether you’re a business or an individual, our team can walk you through the options and help you make the best decision.