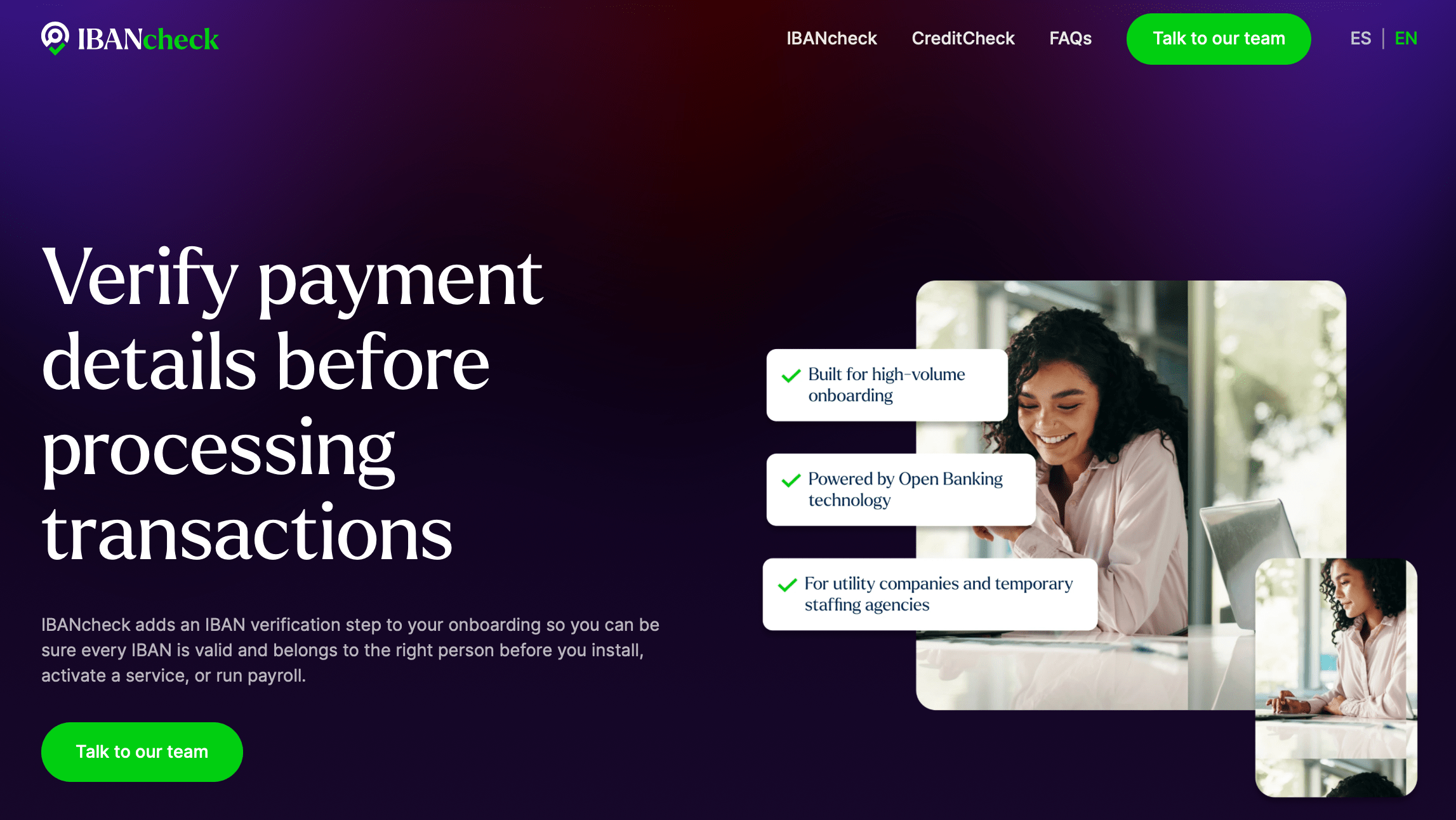

Introducing IBANcheck & CreditCheck: Open Banking tools for verified onboarding

After months of validating the idea and refining the solution, we’re thrilled to announce the official launch of IBANcheck and CreditCheck. These two new tools are designed to help businesses verify financial information before it turns into operational cost, failed payments, or unnecessary risk.

Both tools are powered by Open Banking technology and available through a single platform. They can be used independently or combined into one seamless flow, depending on your needs.

When onboarding and risk decisions rely on unverified data

Onboarding customers, workers, or applicants is expensive. It involves acquisition costs, checks, setup, activation, internal processing, and operational time. Yet many businesses still rely on self-reported financial information, IBANs that aren’t verified until the first payment fails, and manual checks that slow down decisions.

The same exposure exists when starting to work with new suppliers. If payment details aren’t verified before the first transfer, businesses risk sending funds to incorrect or manipulated IBANs due to simple errors or fraudulent redirection.

This results in failed first payments or payroll runs, lost onboarding and setup costs, extra back-office work to fix avoidable issues, and higher exposure to fraud, disputes, and operational risk.

Unverified data doesn’t just create risk, it quietly erodes margins.

One platform, two complementary tools

IBANcheck and CreditCheck are two different products, built to solve two connected problems:

- IBANcheck answers a simple but critical question:

Does this IBAN really belong to the person I’m onboarding?

- CreditCheck goes one step further:

Based on verified bank data, does this person have the financial capacity and stability I need to assess risk?

You can use either tool on its own or combine both into a single onboarding or screening journey that verifies ownership and financial reality.

This is how they work.

IBANcheck — Verify IBAN ownership before onboarding is complete

IBANcheck adds a verification step to your onboarding process, ensuring that every IBAN is valid and belongs to the right person before you activate a service, run payroll, or initiate payments.

Key benefits:

- Catch incorrect or mismatched IBANs early.

- Reduce failed payments and payroll errors.

- Recover more onboarding and setup costs.

- Built for high-volume onboarding.

This tool is ideal for:

- Utility companies (energy, telecom, water, gas).

- Temporary staffing and employment agencies.

- Any business onboarding large numbers of users with bank accounts.

CreditCheck — Understand creditworthiness with verified bank data

CreditCheck analyzes verified financial data retrieved directly from applicants’ banks via Open Banking. Instead of relying on what people say, you assess risk based on what their bank data shows.

Key benefits:

- Assess creditworthiness using verified income and spending data.

- Identify red flags hidden in self-reported information.

- Reduce manual review and approval friction.

- Build accurate customer profiles for smarter decisions.

Common use cases include:

- Rentals and leasing.

- Consumer financing and BNPL.

- Subscription and service businesses.

- B2B credit terms and customer segmentation.

Built for real operations, from verification to decision

IBANcheck and CreditCheck are designed to plug directly into existing onboarding and decision flows, without slowing teams down or complicating the user experience. They’re secure, compliant by design, and built to scale, with API-first integrations and white-label options that adapt to your operational reality.

These tools are for businesses that depend on reliable payments, clean payroll runs, and confident approval decisions. Whether you use one or both in a single flow, IBANcheck and CreditCheck will allow you to verify early, reduce friction, and make better decisions with confidence.

Turn verification into a business advantage

At Clovr Labs, we design and build technology at the intersection of fintech, cybersecurity, and digital infrastructure. We work with high-liquidity and high-volume businesses to reduce risk, simplify complexity, and turn security and verification into operational advantages.

IBANcheck and CreditCheck are the result of that approach: practical tools built from real operational experience, designed to solve concrete problems in onboarding, payments, and financial decision-making.

If you’d like to learn more, see how the tools work in practice, or explore how they could fit into your existing flows, talk to our team. We’ll be happy to walk you through the pricing options and help you get started.